The following page will ask you for information about your business, address, and detailed contact information.

You can't process real credit cards until this approval/activation process is complete.

Activate your AccountĬlick " Activate your account" in the top left of the screen. Click on the link in the email to confirm your email address. You will receive an email to confirm it's really you. The account funding will be paused until this process is complete. Although Stripe will approve your domain with an aol.com or email address, once your account starts processing a large number of orders, Stripe will require verification that you own the domain, so they will require changing the email address. It is important to use the domain of your website as the main email for the account. Complete your name, email and create a password. Sign-up for a Free Accountįirst, you will need to sign up for a free account. You only pay fees for successful transactions.īefore signing up you may want to review fees and how it works. The stripe account is free, meaning there are no monthly fees.

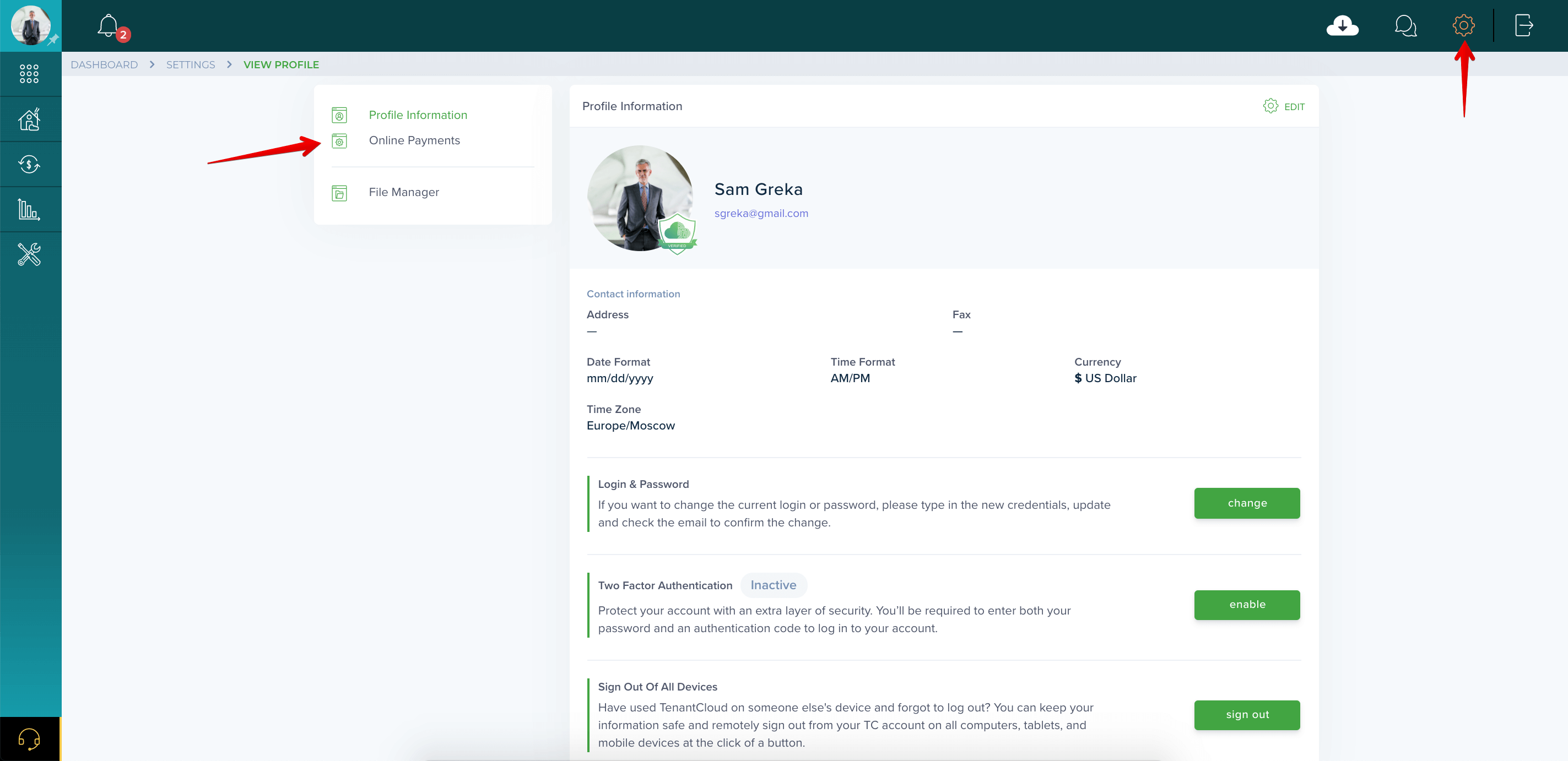

To activate credit card processing you will need to set up a stripe account. Stripe is used in Online ordering to accept Delivery and Pick-up / to-go orders. We use this if you don’t explicitly specify a tax code on a shipping rate in a Checkout session.Stripe is a payment service that allows you to accept credit cards for online transactions. Otherwise, you should select the most appropriate tax treatment for your business. If you’re selling digital goods or services, or if you’re located in the EU, you don’t need to select anything. Some countries have a unique tax rate for shipping fees. In some countries, the tax rate used to calculate the correct amount of tax on your product is the same rate that’s applied to the shipping fees. Learn more about products, prices and tax categories.ĭefault shipping tax code: A shipping tax code determines what type of tax treatment to apply when shipping (delivery) fees are added to the price that you charge. We use this if you don’t explicitly specify a tax_code, which maps to tax categories, on your products or in product_data on your transactions. You must select the correct product tax category for your product or service. We use this to make sure that the correct tax rate is applied to your transactions. Default product tax category: A product tax category is a classification of your product or service for Stripe Tax.

0 kommentar(er)

0 kommentar(er)